A: If you work in construction and you invoice another business (contractor) rather than the home-owner or “end-user” then the business that is paying you is legally obliged to deduct tax from your invoice under the Construction industry scheme (CIS) rules and in this scenario, you are the subcontractor.

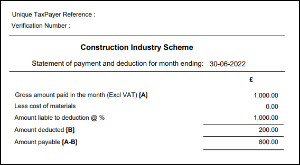

The tax that the contractor has deducted from your payment between the 6th of one month to the 5th of the next month needs to be paid to HMRC each month and the contractor is legally obliged to give you a monthly statement showing the total paid and the tax deducted, a bit like a payslip. You will need to keep all these monthly statements to use in your own tax return at the end of the year.

As a subcontractor, you must register under the CIS scheme with HMRC otherwise your contractor will deduct 30% from your payments. If you are registered with HMRC, then the only deduct 20% (in some cases, if you qualify for “gross status” then 0% is deducted).

Common mistake:

Some contractors simply deduct 20% without checking that their subcontractors are registered AKA “verified” with HMRC. In these circumstances, the contractor might be at risk of paying the extra 10% to HMRC unless they can get it back from the subcontractor:

eg. Sam is an electrician who does a first fix on an extension for John who is the builder. Sam invoices John £1,000 and John deducts £200, paying Sam £800. Since Sam isn’t registered with HMRC, John should have deducted £300 but since he didn’t, then HMRC chased John for the extra £100 payment. John could no longer get hold of Sam and so John had to pay this to HMRC.

If you work in construction and you’re not sure – come talk to LeeP Accountants – we are the experts in CIS and can help you save tax as well as keep you on the right side of the rules