Accountancy Firm Peterborough – Mission Statement

Here at LeeP Accountants, we have one goal: to help your business be the best it can be. Whether that’s by giving you the best advice on tax matters, helping you streamline your accounts, or preparing your VAT returns, we can support you every step of the way. We are Quickbooks & Xero Advanced Certified Pro-advisors and are here to help you move to ‘Digital Accounting’. Although we are in Peterborough, Cambridgeshire, with cloud accounting we are readily on hand to support your business across the nation.

We pride ourselves in being accountants with a difference – we provide a knowledgeable straight-talking approach to your business finances with a fee structure that is easy to budget for and won’t give you any surprises. Why not get in touch and find out for yourself?

Check out our client testimonials and reviews on Google!

Who are we?

Polly Lee

Partner

“I’m a chartered accountant, member of the Institute of Chartered Accountants England & Wales (ICAEW) and qualified 15 years ago with PricewaterhouseCoopers in Cambridge. Since then I’ve led finance departments in various local and national businesses. I believe that customer service is the core to successful relationships and my goal is always to “surprise and delight” you as the client. A good reputation is the foundation of a strong business and so will always strive for a level of customer service to be proud of.”

Diana Phillips

Bookkeeper

“My passion is all things numbers and so the bookkeeping role here fulfils my dream. At LeeP I can be found preparing payrolls, reconciling clients’ bank accounts, preparing VAT returns and looking for ways for clients to streamline their processes to ensure their books & accounts are in tip top condition. Outside of the office, I am a big “gamer” and considered a bit of an X-box nerd”

Shelley Kitchen

Bookkeeper

“Having spent the last 15 years working with Formula One teams I am highly experienced with ensuring accurate and timely service levels. Client satisfaction is of utmost importance to me, which is why I feel well suited to working here at LeeP where we genuinely value our clients as you can see from the feedback. My areas of expertise are VAT & payroll and I am especially proud of my Quickbooks Certification which lends itself well to ensuring my VAT-clients are “Making-tax-digitally” compliant with the new HMRC digital VAT rules.”

Donna Roe

Accountant

“I am an AAT Level 4 accountant and am both QuickBooks and Xero certified. My previous experience working with Wheels (formerly Taz motorcycles) and a local fencing company has ignited my love for accounting and helping small businesses to grow. I have an affinity for first class customer

care and enjoy being able to make a difference to our clients.”

Georgina Heanes

Accountant

“I’ve spent the last 10 years working in automotive debt recovery and repossession sector so am no stranger to dealing with challenging situations involving people’s finances. I have an AAT level 4 Diploma in Professional Accounting and an advanced Quickbooks ProAdvisor as well as being fully Xero certified. My role here at LeeP is to prepare Accounts, tax returns and liaising with customers to ensure business guidance is proactively given in a timely, appropriate and usable manner”

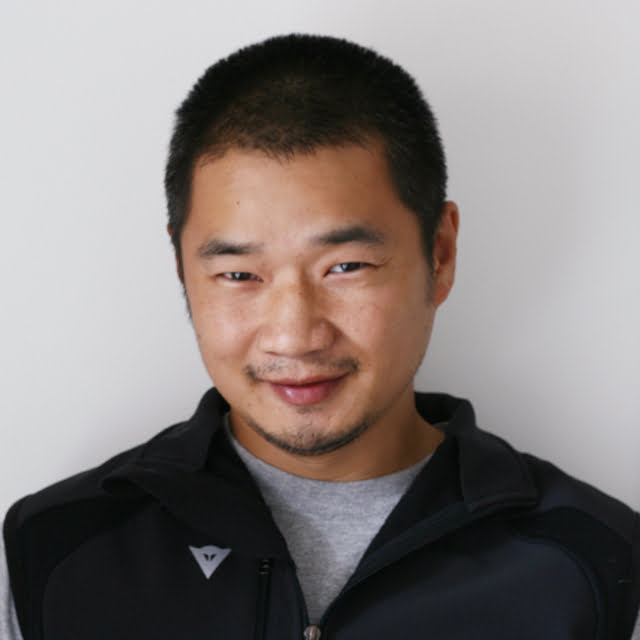

Kar Lee

Brand Manager

“I am a qualified graphic designer with a background in marketing, advertising, and brand identity. My role in LeeP is to ensure the right messages are communicated in our strategies and I implement all the design and advertising campaigns whilst ensuring there is consistency across all marketing elements.”

Jackie Bradshaw

Office Manager

“My role within LeeP is to ensure no one misses any deadlines, the office runs smoothly and the team works as one well oiled machine. My background in credit control for a national concrete company and payroll for the local council means that I have a varied repertoire of finance related skills

and can turn my hand to many of the tasks here within LeeP”

Jo Burke

Assistant Accountant

“My role here at LeeP is all things VAT and Xero. I am a certified Xero trainer and can hand-hold customers through the transition to digital accounting. I am a qualified ICB Level 2 bookkeeper and am also currently studying for my AAT Level 3 certification. Having experienced working in a variety of different accountancy firms previously, I am thrilled with the LeeP team values and culture and this seems to translate to the relationships we all have with our clients. Out of work, my passion is Rugby, Rugby and Rugby (Union) – I am captain of the Deeping Devils women’s Rugby squad and I am known to dive straight into the nitty gritty on pitch!”

Dave Chaudhari

Payroll

“As a Business management graduate I have experience across a wide range of accounting functions but I now live and breathe all things payroll. Happiness is immersing myself into a large employer month end payroll! When not running pay, I can normally be found on the football pitch or competing in chess tournaments as a grand master”